Critical Infrastructure / Posted on November, 11 2024 / Author: by Jeniece Pettitt

Posted on November, 11 2024 / Author: by Giulia Bottaro

Critical Infrastructure / Posted on November, 11 2024 / Author: by Steve Levine

Critical Infrastructure / Posted on August, 9 2024 / Author: by James Bikales

Posted on December, 1 2023

General Motors continues to build its Ultium Cells battery plant near Lansing as the automotive industry confronts slower-than-expected electric vehicle sales and high capital costs to build them. As it cuts costs, GM is pausing construction at its Orion Township Assembly factory, which was paired with the Ultium factory for over $600 million in state economic development incentives.

General News / Posted on November, 22 2023

Long-awaited guidance from the US Treasury Department that could prevent automakers from buying materials from China will likely resemble regulations aimed at protecting the US semiconductor industry, industry experts told S&P Global Commodity Insights.

General News / Posted on November, 6 2023

ENERGYWIRE | The news that big auto companies like General Motors and Ford Motor are slowing their electric vehicle rollouts has one group a bit relieved: battery-makers.

This nascent U.S. industry has received $58 billion of investment in the year since the Inflation Reduction Act became law, according to Jay Turner, a professor at Wellesley College in Massachusetts who maintains an EV-investment database. That’s far more than any other part of the EV ecosystem. People in the industry say they could use a break from this red-hot streak to catch their breath.

Posted on October, 11 2023 / Author: CAITLIN OPRYSKO

A group of domestic battery stakeholders is also banding together to try and make sure that in all the attention being paid to investing in sustainable supply chains for critical minerals and other materials that go into making batteries, investing in domestic production of the machinery that manufacturers batteries doesn’t fall by the wayside.

— U.S. Battery Machine Builders includes Abbott Furnace, Bechtel Global Corporation, BW Papersystems, Charles Ross & Son Company and Siemens, and argues that a focus on onshoring equipment for everything from extracting critical minerals to assembling batteries will accomplish the same sustainability, economic and national security objectives cited in focusing on the supply chain for the raw materials themselves.

Posted on August, 28 2023 / Author: Daniel Moore

US battery projects have proliferated since the Inflation Reduction Act was enacted one year ago, outpacing other clean energy technologies encouraged by the climate-and-tax law and spotlighting a heavy lift of shifting supply chains from China.

Since August of 2022, when President Joe Biden signed the law, Bloomberg NEF has tracked $72 billion of announcements by automakers, battery manufacturers, and other stakeholders in the electric vehicle supply chain. That includes nearly $55 billion for battery-related projects.

While the industry’s supporters celebrate the progress, they acknowledge the scale of the investment represents the daunting challenge of turning the hype into reality.

Much of the battery supply chain is dominated by China, and the US battery plants sprouting up to supply electric vehicle manufacturing and power grid storage are weighing cheaper costs of imported materials while signing deals with US producers.

“Now is this incredible opportunity in time in our industry,” said Chris Burns, co-founder and CEO of NOVONIX, an Australia-based battery technology firm building a 400,000-square-foot synthetic graphite production facility in Chattanooga, Tenn.

The NOVONIX plant, expected to begin operation next year, will produce at least 10,000 metric tons per year of synthetic graphite for battery cell company Kore Power, and the company’s US workforce has grown to 120 people. It plans to finalize a $150 million grant from the Department of Energy to help pay for a new plant in the Southeast that will initially target 30,000 metric tons per year of production capacity for LG Energy Solution with an option for LGES to buy up to 50,000 tons of the material over a 10-year period.

Graphite is an essential material for anodes in lithium-ion batteries, but production is dominated by China. The US funding and permitting regime means production is still being deployed slower than China, which continues to build graphite facilities in one year that are five times bigger and half the cost of those in the US, Burns said.

“We have huge challenges competing with China because of the maturity of their industry, as well as their ability to deploy capital very quickly,” Burns said.

Leveling the Playing Field

The Biden administration and bipartisan members of Congress have sought to level the playing field between the US and China. The battery supply chain spans mineral mining, refining and processing, production of components like cathodes and anodes, and final battery assembly.

In 2021, the Infrastructure Investment and Jobs Act allocated $7 billion to the Energy Department to award grants to companies throughout the battery supply chain. In October 2022, the agency announced $2.8 billion for nearly two dozen companies, including NOVONIX. The DOE plans to announce the second round of funding awards before the end of the summer.

The climate law, enacted in August 2022, included the 30D electric vehicle tax credit for batteries that are assembled in North America and for batteries that source a certain percentage of critical minerals from the US or trade allies. The minimum percentage increases annually to 100% and 80%, respectively, by fiscal year 2029.

This month, the White House reported the US share of global battery manufacturing capacity is projected to almost double by 2030 and have enough capacity to meet US demand for EV batteries.

The climate law was designed to spur companies to invest, and “it’s quite clear it’s working, just based on the sheer number of deals we’re seeing,” said Lauren Collins, a tax and renewables partner at Vinson & Elkins LLP, referring to energy investment broadly. “It seems like every day we’re getting a term sheet or a tax credit transfer deal.”

Targeting Gaps

The DOE’s battery supply chain program has tried to surgically aid companies aiming to fill supply chain gaps, Steven Boyd, the agency’s acting deputy director for battery and critical materials said in an interview. The US has some of the lowest capabilities in processing materials, such as lithium, nickel, and cobalt, as well as graphite and cathode materials needed for batteries, Boyd said.

“Those earlier-stage types of materials and those processing capabilities, that’s really where we think the investments have moved the bar,” Boyd said.

The second round of funding, expected to be about $3.2 billion, will be announced later this summer and could target electrolytes and binders for cells. “As a supply chain, you’re only as strong as your weakest link,” he said.

Some materials buyers in the auto sector remain concerned about higher prices of inputs made in the US and some trade allies compared with China, said Todd Malan, chief external affairs officer and head of climate strategy for Talon Metals Corp.

Talon operates a nickel-copper-cobalt mine in Minnesota and received a $114 million grant from the Energy Department to build a processing facility in North Dakota, covering about 27% of the total cost. Malan also pointed to the 45X Advanced Manufacturing Tax Credit that provides 10% production tax credit for supply chain companies.

“There’s a lot in these laws that have yet to be fully rolled out that will be even more resources to support an ex-China supply chain,” Malan said. “There’s really strong policy, really strong financial support, and we’re seeing a private sector response.”

Policy Decisions

Major policy decisions still have to be made, including how to treat companies that have had experience with China, said Ben Steinberg, executive vice president and co-chair of Venn Strategies’ critical infrastructure group and a former Energy Department official.

The government must also precisely deploy trade barriers to allow the US industry to grow without raising costs for producers down the supply chain. A 25% tariff on imported graphite, for example, has been waived for years to keep costs competitive, but now companies like NOVONIX are ramping up.

“A large majority of these gigafactories will happen in some capacity,” Steinberg said, using a shorthand for large-scale battery factories.

“The question remains whether we will be importing a majority of the materials and the components that make these batteries for electric vehicles and the grid, which is what we’re doing now,” Steinberg said.

To contact the reporter on this story: Daniel Moore in Washington at dmoore1@bloombergindustry.com

To contact the editors responsible for this story: Zachary Sherwood at zsherwood@bloombergindustry.com; JoVona Taylor at jtaylor@bloombergindustry.com

Posted on August, 8 2023 / Author: BY ELIOT CHEN

An American mining start-up gained the powerful endorsement of the U.S. Defense Department last month, when it received a $37.5 million grant to develop what could be the country’s largest graphite deposit, close to Nome, Alaska. The company, Graphite One (Alaska) Inc., aims to be America’s first domestic miner of graphite, a mineral that’s vital for producing electric vehicle batteries and is used widely in the defense sector.

But Graphite One’s fortunes will likely depend on the assistance of a familiar rival: China. That’s because a key advisor aiding the company’s plans to build a domestic battery anode factory is a Chinese firm founded by executives with deep ties to China’s battery industry.

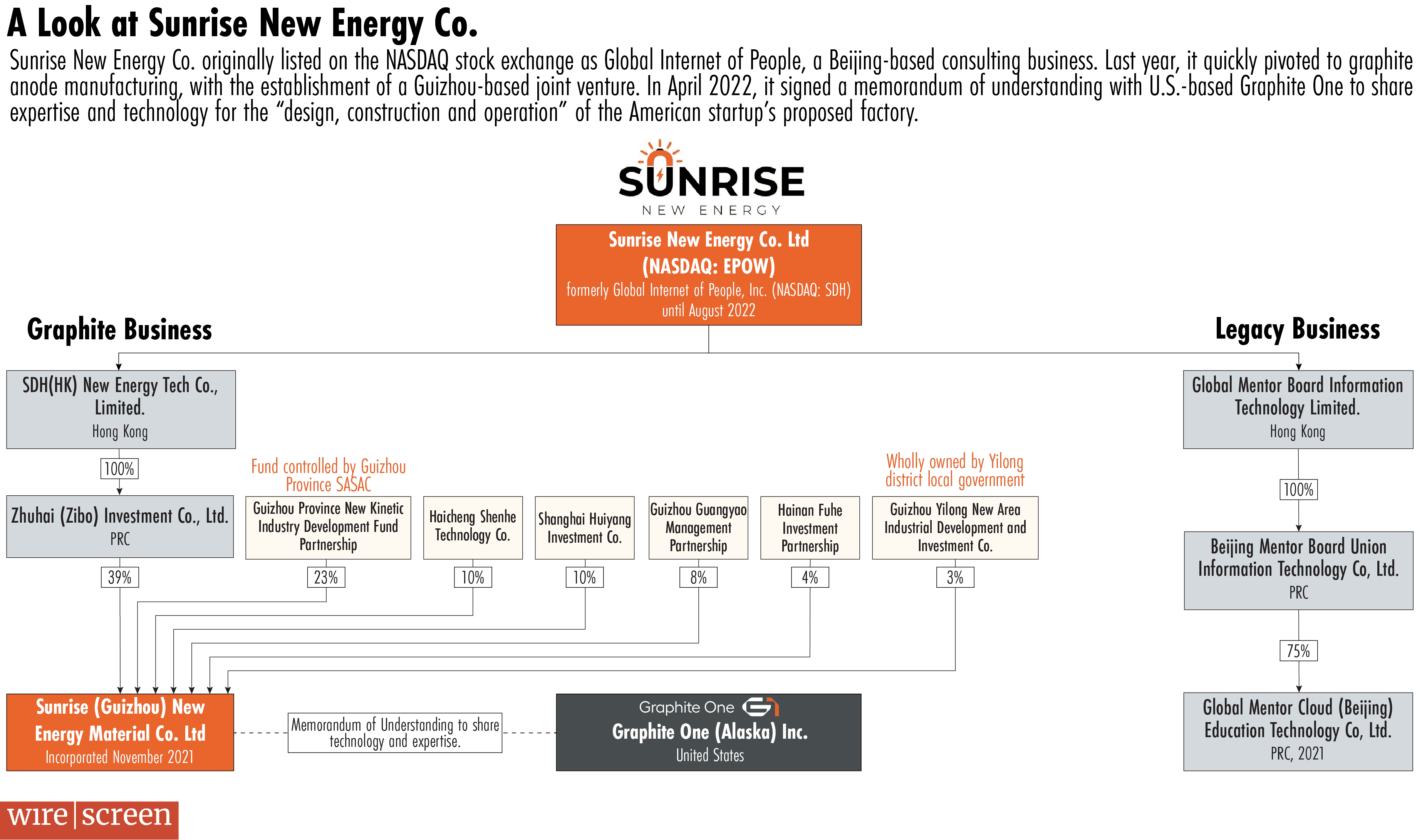

In May 2022, Graphite One announced an agreement with Guizhou-based Sunrise New Energy Material Co. — also known as Sunrise Guizhou — that will see the Chinese firm share expertise and technology for the “design, construction and operation” of Graphite One’s proposed battery parts factory in Washington state.

As critical minerals increasingly become a geopolitical flashpoint between the U.S. and China, the apparent conflict of interest at Graphite One could raise uncomfortable questions for the firm and the policymakers who have thrown their weight behind it.

China dominates the mining and processing of graphite, accounting for 61 percent of global mine production and 98 percent of processing, according to Benchmark Mineral Intelligence, a research firm. Graphite One’s pitch — amplified by politicians including U.S. Senator Lisa Murkowski (R-AK) — is that it will help America break China’s grip over the industry.

“[Graphite One’s project] will be a secure supply of natural graphite from day one, without the political and the security risks associated with so many projects that are located abroad,” Murkowski said in a Senate speech last month.

Given China’s overwhelming dominance over the graphite industry, it is little surprise that an upstart American firm should require its help. “You have a burgeoning suite of battery anode companies emerging in North America,” says Ben Steinberg, executive vice president at Venn Strategies, a lobbying firm which represents companies in the critical mineral sector, not including Graphite One.

…most fully-formed companies in this industry are in China or touching China in some way, because that’s where the majority of the chemical processing and tech has been developed in the last 10 to 15 years.

Ben Steinberg, executive vice president at Venn Strategies

“But most fully-formed companies in this industry are in China or touching China in some way, because that’s where the majority of the chemical processing and tech has been developed in the last 10 to 15 years,” he says. “I do think there could be value gained in working with those companies if done carefully. The question is how the government will protect the U.S. graphite industry and investments given China’s dominance to date.”

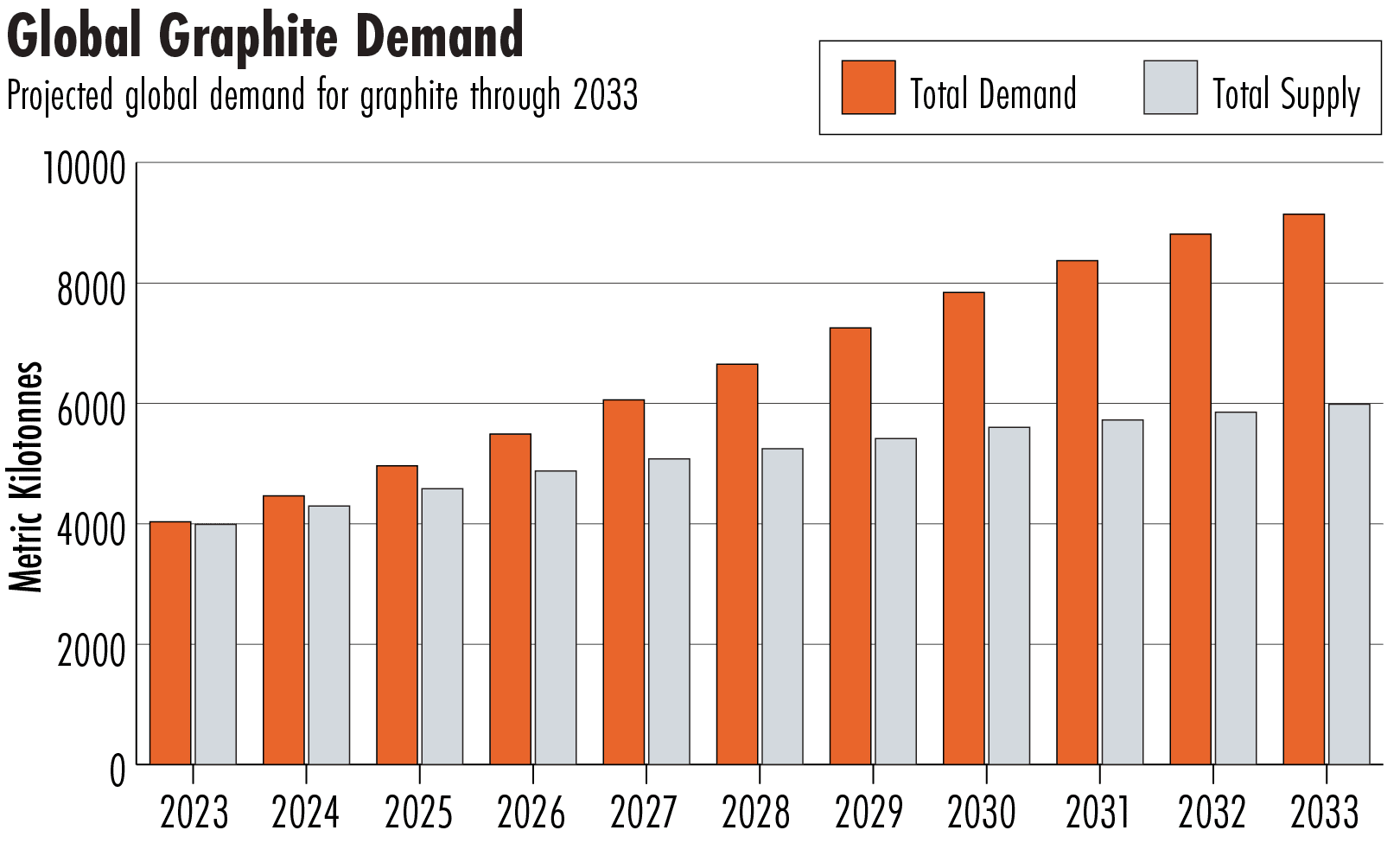

Graphite One (Alaska) Inc. is a wholly owned subsidiary of Graphite One Inc., a listed company headquartered in Vancouver, Canada. The company plans to construct a vertically integrated supply chain, spanning from its Alaskan graphite mine to an anode factory and battery recycling facility to be built in Washington state. Graphite One calculates it will be able to churn out an average of 75 kilotonnes (kt) of anode material per year over the project’s 26 year lifespan. Global demand for anode material is surging alongside the adoption of EVs, reaching 300 kt in 2021, according to the International Energy Agency.

The unusual origins of Sunrise Guizhou add to the intrigue around its technology sharing agreement. While Graphite One has previously described Sunrise as “an experienced battery anode producer,” the Chinese company is in fact a nascent venture, incorporated just months before it landed the agreement.

Public filings and ownership records show how Sunrise’s operations were hastily formalized, beginning soon after an initial public offering in 2021. That February, a Beijing-headquartered company named Global Internet of People Inc. listed on the NASDAQ stock exchange, raising $26.9 million. The company is described in its prospectus as a “consulting company providing enterprise services to small and medium-sized enterprises,” with a “peer-to-peer knowledge sharing and enterprise service platform.”

Global Internet of People’s filings in the leadup to its IPO offer little indication of the company’s experience in the graphite business. But nine months later, in November 2021, it established Sunrise Guizhou as a joint venture via a wholly owned subsidiary, Zhuhai Zibo Investment Co., which held a controlling 51 percent stake in Sunrise. The other investors in the joint venture included a number of privately-owned funds and an investment firm controlled by the local government of Yilong district, in the southern province of Guizhou where the company’s facilities are located, according to data from WireScreen.

Global Internet of People’s directors approved Sunrise’s formation on April 1, 2022. Graphite One announced its technology sharing agreement with Sunrise five days later. Solidifying the parent company’s pivot to batteries, Global Internet of People’s shareholders then greenlit its renaming in August 2022, to Sunrise New Energy Co. Ltd.

Covid was a key driver behind the company’s pivot to graphite, the company’s chairman and CEO, Hu Haiping, said in an interview with The Wire. Prior to entering the consulting business, Hu was a longtime executive at Shanshan Group, parent company of Ningbo Shanshan Co., one of China’s largest manufacturers of battery anodes. The 20-year veteran of Shanshan struck out on his own in 2015, hoping to build an app-based platform that would provide advice to other entrepreneurs. But with small businesses hurting during the pandemic, Hu says interest in the platform fell, leading him back to graphite. In short order, Sunrise recruited a phalanx of veteran engineers and executives with experience in the battery sector.

From a technical standpoint, “having the participation of Hu Haiping is definitely a good sign for Graphite One,” says Albert Li, head of China analysis of Benchmark Mineral Intelligence. “Shanshan has been the leading anode producer in China for about a decade, and Hu was the founder and first general manager of Shanshan Technology. He likely already knows everyone in the supply chain.”

In the months after Sunrise signed its agreement with Graphite One, it also landed orders for its graphite anodes from major EV battery producers including Chinese industry leaders CATL and BYD. The company has rapidly scaled up production: Hu says that after just a year and a half of operations, his company is currently producing 3000 tonnes of anode material per month.

The Chinese government has also become a significant investor, after a fund controlled by Guizhou’s provincial government acquired a 23 percent stake in Sunrise Guizhou for 200 million renminbi ($27.8 million) in June 2022.

For officials in Washington, that could be a cause for concern. In response, Hu says that Sunrise’s management is completely independent, and that the provincial government has never intervened in his company’s daily activities.

There are other advantages for Graphite One in partnering with a relatively young Chinese company, such as Sunrise’s apparent distance from potentially troublesome connections to China’s military. Graphite has important applications in the defense sector, notably in the nozzles of rockets and the exterior coatings of drones, and a number of established Chinese graphite companies have military ties.

Records from WireScreen show that Shanshan Group, for example, controls a subsidiary located in a military civil fusion-focused industrial park. China has pursued the controversial strategy, promoted by President Xi Jinping, which involves fusing the country’s military and civil industrial and technological capabilities. The U.S. government has imposed sanctions in recent years on Chinese firms alleged to be involved in military-civil fusion.

Ownership records reviewed by The Wire found no financial ties linking Shanshan Group and Sunrise, nor ties between Sunrise and military-civil fusion.

As for Graphite One, the DoD’s grant will accelerate its planning process, enabling the company to move up the completion of its feasibility study by a full year.

Securing a domestic raw material supply is one thing — developing the expertise to manufacture complex battery anodes independently is another. Sophisticated factory equipment that China’s producers have spent years honing, notes Benchmark’s Li, are “not something you can copy and paste.”

The path to get there is already narrowing. According to Sunrise’s Hu, U.S.-China political tensions means he’s not sure whether his company will be permitted to export the advanced technology that Graphite One needs to develop its battery anodes. He says that Sunrise’s lawyers are still working out how to continue with the partnership in compliance with Chinese law.

Posted on August, 2 2023 / Author: by HANNAH NORTHEY

General News / Posted on June, 8 2023 / Author: by Bennett Resnik

Policy with bipartisan support is hard to find these days. Luckily, one of them involves the laudable effort to have more U.S.-made products used in federally funded contracts, such as public works and infrastructure projects. For these efforts to thrive and achieve a balanced Buy America policy, the government must reduce bureaucratic complexity, ensure greater transparency and tackle other problems that impede achieving the goals of domestic preference policies. Striking the right balance for Buy America requires a careful consideration of various factors such as economic benefits, job creation, exemptions and waivers and international trade obligations.

Domestic preference laws date back to 1933, though there were earlier laws at the state and local levels that encouraged domestic sourcing. Congress and President Herbert Hoover enacted the Buy American Act during the depths of the Great Depression as part of the National Industrial Recovery Act, creating a preference for U.S.-made products in its procurement of goods and services. Over time, subsequent laws expanded this effort.

In 1978, the Buy American Act was included as part of the Surface Transportation Assistance Act, which extended domestic-preference rules to federally financed transportation projects, such as airports, highways and public transit systems. Today, the Build America, Buy America Act, enacted as part of the Infrastructure Investment and Jobs Act, requires all federal agencies to ensure no federal financial assistance for “infrastructure” projects be provided “unless all of the iron, steel, manufactured products and construction materials used in the project are produced in the United States.”

These laws became more urgent—but also more complicated—as they were applied to new initiatives. These include President Joe Biden’s 2021 Executive Order on “Ensuring the Future Is Made in All of America by All of America’s Workers” and the Inflation Reduction Act, which includes the Clean Vehicle Credit (an electric vehicle tax incentive under IRS section 30D with battery sourcing requirements).

Each statute is unique and enacted with different requirements and policy goals in mind. The overarching goal, however, is the same: To boost domestic manufacturing and supply chains while increasing U.S. jobs and promoting economic development nationwide. But how does this happen effectively and efficiently?

The Build America, Buy America Act applies “Buy America” to all federally funded infrastructure and public works projects. Though simple in purpose, its requirements can vary depending on the program or project involved. This makes it harder for contractors to navigate the various rules and regulations, which, of course, are meant to minimize waste and misuse.

The Office of Management and Budget—and specifically its Made in America Office – has made progress in implementing President Biden’s January 2021 Executive Order and requirements under the Build America, Buy America Act and has been a strong tip of the spear on domestic preference policy efforts. A remaining core challenge involves agencies determining how to apply domestic-preference guidance to their infrastructure programs and processes.

Critics of Buy America policy argue it increases costs and reduces efficiency. However, these concerns can be addressed by ensuring the policy is implemented in a way that balances the economic benefits with the costs. For example, exemptions and waivers can be provided for goods and materials when strict adherence to the laws is not in the public interest, when the needed materials are not sufficiently available in the U.S. and when using U.S.-made materials would increase a project’s overall cost by more than 25 percent. Timely approval of these requests can help prevent project delays while ensuring the overall objectives of the law are still being met.

These aren’t easy matters. A phased transition, which includes a steady increase in domestic sourcing percentage thresholds to manage supply chains and materials acquisition, is critical to ensuring the viability of any domestic-preference policy.

Additionally, many industries have complex supply chains involving multiple tiers of suppliers and subcontractors. One of the main challenges here is ensuring all required materials and components are made in the U.S. This can be difficult, as many products are made with parts or materials sourced overseas, and it can be challenging to trace the origin of every component in a complex supply chain.

The government should reduce the administrative burden for Buy America compliance to help businesses—especially small- and medium-sized enterprises—compete for contracts without inordinate red tape. Inconsistent implementation of Buy America policies causes undue problems for manufacturers and project sponsors. They become unable to conduct long-term capital project planning, provide investors with peace of mind and predict how the government will treat project bids.

One of the most effective ways to reduce the administrative burden for Buy America compliance is to simplify the requirements. This can include providing clear definitions that apply across the federal government, reducing the number of required certifications and curtailing the amount of paperwork and other administrative tasks.

Greater transparency around the compliance process can also help reduce administrative burdens by enabling businesses to better understand the compliance requirements. Measures could include providing training materials and compliance best practices and ensuring compliance processes are clearly defined and communicated. Technical assistance, such as workshops, webinars or roundtable discussions, would also help.

Most Americans across the political spectrum support Buy America policies and rightly so. The policies support domestic production, enhance national security, certify quality and safety standards and support environmental interests. They promote fair competition by preventing the improper undercutting of domestic prices or distorting market competition.

Inconsistent implementation of Buy America policies, excessive administrative requirements and delays in approving appropriate waivers can hamper the program’s worthy goals. By continuing to address these challenges, the government can responsibly boost U.S. production and jobs.

————-

Bennett E. Resnik is a senior vice president in the Critical Infrastructure Practice at Venn Strategies. The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the views of Venn Strategies or its clients.